Situs Slot Gacor Maxwin Terpercaya memang menjadi pilihan utama bagi para pecinta judi slot online. Dengan reputasi yang terpercaya dan kemenangan yang konsisten, tak heran jika situs ini banyak dicari oleh para pemain. Slot gacor hari ini selalu menjadi incaran para bettor yang ingin mendapatkan keberuntungan dalam bermain.

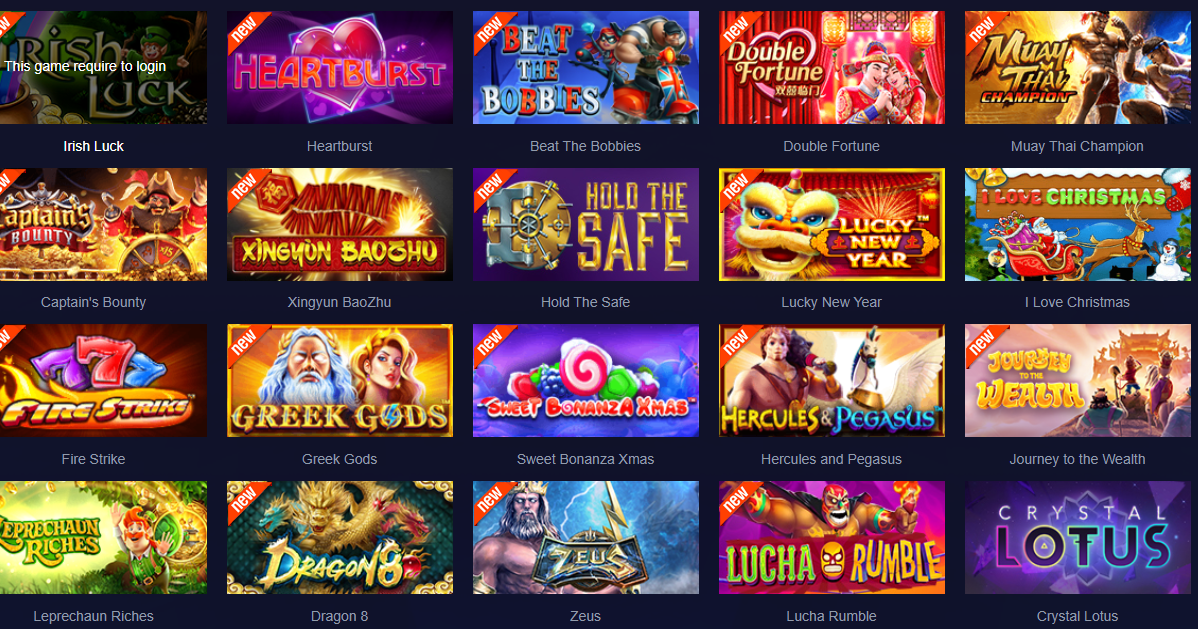

Dengan beragam pilihan slot gacor terbaru yang disediakan oleh situs ini, memberikan kesempatan bagi para pemain untuk merasakan sensasi bermain slot online yang seru dan menguntungkan. Tak hanya itu, keamanan dan kenyamanan pemain juga menjadi prioritas utama dari situs slot gacor Maxwin Terpercaya ini. Dengan daftar slot online yang mudah dan proses transaksi yang cepat, membuat pengalaman bermain semakin menyenangkan dan mengasyikkan.

Strategi Bermain Slot Gacor Maxwin

Bagi para pemain Slot Gacor Maxwin, strategi bermain sangatlah penting untuk meraih kemenangan secara konsisten. Salah satu strategi yang dapat diterapkan adalah dengan memahami pola permainan slot tersebut. Dengan menganalisis pola-pola yang muncul, Anda bisa meningkatkan peluang untuk memenangkan hadiah-hadiah menarik.

Selain itu, penting juga untuk memperhatikan besaran taruhan yang digunakan. https://bonanza777.bet/ taruhan sesuai dengan kekuatan modal yang dimiliki akan membantu dalam mengoptimalkan hasil kemenangan. Jangan terlalu gegabah dalam memasang taruhan besar jika belum yakin dengan pola permainannya.

Terakhir, jangan lupa untuk memanfaatkan fitur bonus dan promosi yang disediakan oleh Situs Slot Gacor Maxwin terpercaya. Bonus-bonus tersebut dapat meningkatkan peluang kemenangan Anda secara signifikan. Pastikan untuk selalu memantau promosi-promosi terbaru agar tidak ketinggalan kesempatan meraih kemenangan besar.

Keuntungan Bermain di Situs Slot Gacor Terpercaya

Situs slot gacor terpercaya menawarkan pengalaman bermain yang seru dan menarik bagi para pecinta slot online. Dengan reputasi terpercaya, Anda dapat bermain dengan tenang tanpa perlu khawatir tentang keamanan dan kelancaran permainan.

Keuntungan lainnya adalah adanya berbagai bonus dan promosi menarik yang ditawarkan oleh situs slot gacor terpercaya. Dengan bonus-bonus ini, kesempatan untuk memenangkan hadiah besar semakin terbuka lebar bagi para pemain.

Selain itu, situs slot gacor terpercaya juga menyediakan pilihan permainan slot yang lengkap dan berkualitas. Dengan beragam opsi permainan, Anda bisa menemukan variasi slot online favorit Anda dan terus menikmati pengalaman bermain yang memuaskan.

Perkembangan Terbaru Slot Online Gacor

Pada dunia judi slot online saat ini, popularitas situs slot gacor Maxwin terpercaya semakin meningkat. Pemain-pemain mencari keberuntungan dengan bermain di situs ini, yang menawarkan kemungkinan kemenangan terus menerus.

Dengan munculnya slot gacor terbaru setiap harinya, pemain memiliki beragam pilihan permainan menarik dengan tingkat pengembalian yang tinggi. Hal ini memberi kesempatan bagi para pecinta judi online untuk meraih kemenangan besar dengan taruhan yang lebih kecil.

Dengan daftar slot online yang semakin variatif, para pemain dapat menikmati pengalaman berjudi yang seru dan mengasyikkan. Slot online gacor Maxwin menjadi pilihan utama bagi mereka yang ingin mencari sensasi kemenangan tanpa henti.